Real attorneys, powered by technology

Meet the ElmTree Law Team

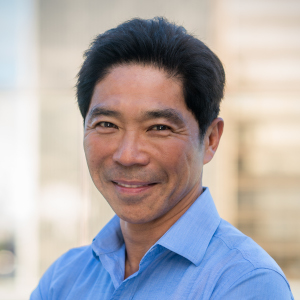

Brian Liu, Esq.

CEO and Founding Attorney

Brian Dennis, Esq.

Senior Estate Planning Attorney

Arya Firoozmand, Esq.

Chief of Customer Experience

Curt Brown, Esq.

Chief of Legal Innovation

Aja Hashian

Director of Client Relations

Luis Luevano

Client Support Specialist

Caty Hall

Client Support Specialist

Sean Williams

Director of Technology

Nick Raleigh

Front-End Developer

Combining caring professionals with time-saving technology

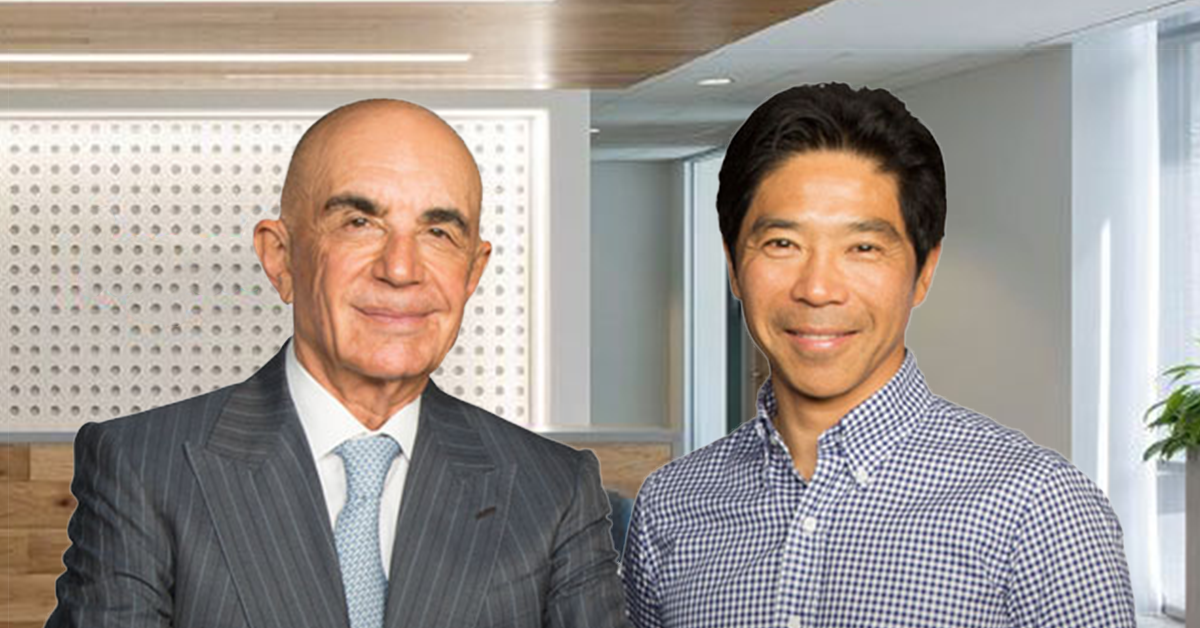

Built by the founder of LegalZoom

ElmTree carries forward our founder’s lifelong mission: to make the law more accessible and ensure everyone can protect what matters most.

Over 10,000 hours of experience

Your estate plan is prepared by experienced attorneys who bring both expertise and care. Each plan is tailored to your goals and needs.

24/7 access to legal help

Get ongoing legal support and access your important legal documents through your smartphone at any time

ElmTree’s founding attorney, Brian Liu, launched LegalZoom in 2000 with a vision to democratize legal services. Today, he continues his lifelong mission to make legal protection accessible for everyone

Our Core Values

To protect families with

trusted legal guidance

QUESTIONS?

QUESTIONS?